Searching tips for first-time home buyers in Texas can help you learn the process of home buying, save money and get approved. With proper guidance and support from your mortgage lender, you dream of home ownership can be achieved as simple and smooth as possible.

At AlexDoesLoans, we can help make your dream of home ownership possible, regardless of your starting point.

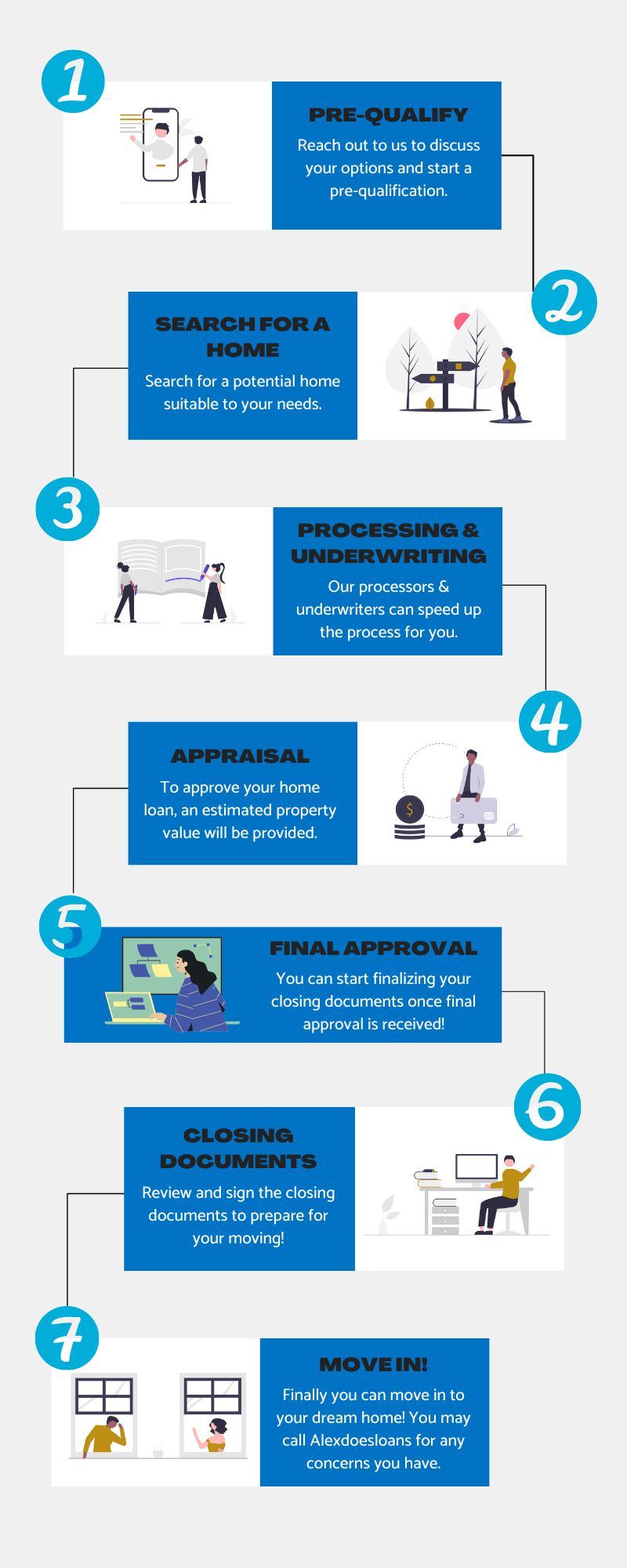

Below are the quick steps to follow as you prepare for buying your first home in Texas.

- Firstly, one of the most important tips for first-time home buyers in Texas is to make sure that finances are in order. This means that you must have already paid off your debts and set aside an emergency fund.

- Make research and learn about the available loan types in Texas. This way, you can compare each loan terms and determine what suits your needs.

- Apply for a mortgage loan in Texas and get pre-approved. This will help you get an idea as to how much you will spend in buying your first home.

- Look up and compare different real estate agents. A good real estate agent will guide you through the home buying process and the details of closing the deal.