When you’re ready to buy a home, it’s important to know the process. This blog post will walk you through each step of the home buying process, from figuring out your budget to getting final approval. We’ll discuss what happens at each stage, and provide some tips on how to make the process as smooth as possible. So whether you’re just starting out or are close to finalizing your purchase, be sure to read this post!

Step 1: Budget

The first step in buying a home is figuring out your budget. This means estimating how much you can afford to spend on a monthly mortgage payment, as well as other associated costs like taxes and homeowners insurance. The quickest way to do this is to take your Monthly Income BEFORE Taxes and multiply it by 35%. This will give you a great starting point on the monthly payment you can qualify for.

Example: I make $5000 per month before taxes. $5000 * 0.35 = $1750 per month.

This can also apply to household income. If I make $5000 and my spouse makes $3850. $5000 + $3850 = $8850. Take the total $8850 * 0.35 = $3097.50 per month.

Now this isn’t a perfect calculation, but it’s a quick and easy way to get an understanding of the payment you can qualify for :).

Step 1A: Estimating Mortgage Payments Quickly

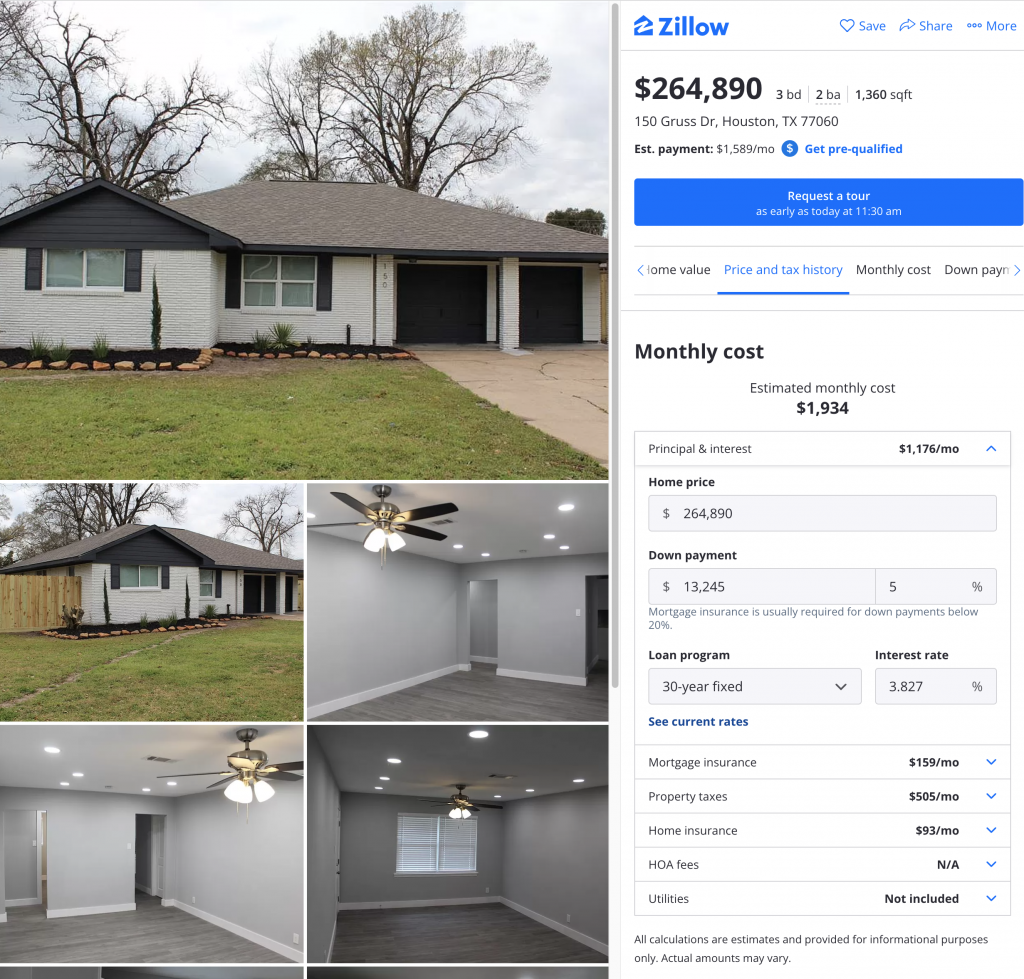

The next step I like to take is to surf around Zillow and find a general house I like and would consider a purchase. Zillow has a “Monthly Cost” section, that is again – somewhat accurate.

Just make sure to open up the “Principal & Interest” section and update the Down Payment to the correct amount.

As you can see, from our above scenario the person whose income is $5000 per month, might not qualify for this home – but the 2 borrowers incomes combined should be able too!

DISCLAIMER – This isn’t the most Accurate way to do this, but if you’re up late one night and are curious, this can help give you an idea. Always consult a Licensed Mortgage Professional for further information – such as me 😉

Step 2: Pre-Qualified / Pre-Approved

The next step is to get Pre-Qualified or Pre-Approved for a mortgage. This is an important step because it will give you a much better idea of the price range you should be shopping in. It’s also a good way to start building a relationship with a Lender, in case you need their help later down the road.

There are two main types of mortgage approvals:

Pre-Qualified – This is a basic approval that states how much money you may be able to borrow. It’s based on your income, debts, and credit score.

Pre-Approved – This is a more in-depth process, where the lender actually looks at your full financial picture. They’ll verify your employment , income, and assets. This gives you a much better idea of what you can actually afford.

Most people start the home buying process by getting pre-approved. It’s important to note that being pre-qualified or pre-approved doesn’t mean you’re guaranteed a mortgage – but it does give you a good starting point.

Steps to Getting Pre-Approved:

Schedule a Pre-Qualification Consultation. This usually consists of a 30-40 minute call to review some of the more major items when qualifying. After the consultation, if moving forward is the right move – we will start with an application.

After the Application, there will be a list of preliminary documents we’ll need to collect. We will verify Income, Credit, money for Down Payment etc. A strong Pre-Qualification can make the difference between winning a home and losing out on multiple offers.

There is the option to be Pre-Approved. This option does take 7-10 business days, we your loan file will need to be reviewed by Processing and Underwriting. Majority of home shoppers don’t require this. But for those who do, it usually comes down to items on the credit report, income variation, and other out of the box scenarios. A Pre-Approval would be recommended if your Mortgage Professional thinks making an offer without one may put your Option & Earnest Money at jeopardy. Always consult with your Mortgage Professional and never be afraid to ask questions!

Step 3: Finding the right Home

Once you’ve been Pre-Approved, it’s now time to start buying a home. This is the fun part! The best way to start your search is by looking online – there are tons of websites and apps out there that can help you find your perfect home.

Some of my favorites are: Zillow, Har and Realtor.com .

You’ll want to work with a Real Estate Agent. They will help you with the search, accessing homes, and negotiating your offer. There is no real benefit to NOT go with an agent. As a Buyer, your Agent is compensated from the Seller. This is already factored in the sale price of the home. This means there main goal is to help YOU.

AND YES! THIS APPLIES TO NEW CONSTRUCTION!

If you’re looking into new construction, ALWAYS consult with an Agent you trust. If you don’t have a solid Agent, reach out. I can connect you with one.

When you’re looking at homes, make sure to keep your budget in mind. You don’t want to fall in love with a home that’s out of your price range.

Another thing to keep in mind is the mortgage process itself. It can take anywhere from 25-35 days to actually close on a home, so keep timing in mind.

Steps to take while House Hunting:

Create a list of what’s important to you and your family. This could be things like number of bedrooms, bathrooms, location, school district etc.

Narrow down your search by only looking at homes that fit your criteria.

Start visiting homes and pay attention to things like the condition of the home, the layout, and the surrounding neighborhood.

Once you’ve found a few homes you like, it’s time to start making offers!

Step 4: Making an Offer:

The next step is to put together your offer. This will include things like the purchase price, any contingencies (like a loan contingency or a home inspection contingency), and earnest money (this is money that shows you’re serious about buying the home).

Your offer will also include your loan terms. This is important because it shows the seller how much you’re willing to borrow and what your interest rate will be.

The offer should also include the closing date that you’re hoping for.

If the seller accepts your offer, you’ll receive a copy of the fully signed contract and be asked to deposit Option & Earnest Money.

Option Fee – The Option Fee or Option Money is paid by you the Buyer to the Seller. This Fee gives you the option to cancel the purchase or pull out of the contract with no strings attached. The time frame is usually 7 days, but can vary between 3-10 days (dependent on what’s stated on the contract.) Option Money usually isn’t refundable.

This is usually made for Home Inspections. A Home Inspection is not required, but definitely recommended on Homes older than 10 years. A Home Inspector will look for any and all defects in the home that may need to be repaired. The average cost for a Home Inspection is $350-500.

Earnest Money – Earnest Money is money given to the Seller as part of your down payment. This shows that you are serious about buying the home and that you have the funds available to do so. Earnest Money on average is 1% of the sales price, but can be favorable to the seller if you offer more. Earnest Money can be refunded in specific cases as per the Purchase Contract. The 2 major reasons being Home not appraising (value of the home is less than the purchase price) and not being able to obtain financing.

At this time, you’ll also be introduced to Title. The title company is a neutral 3rd party that handles the money and signing of the contract between you, the buyer, and the seller. Title is where you’ll bring your 2 cashiers checks (Option Fee and Earnest Money), as well as come back to sign and bring the rest of any funds needed.

Now the mortgage process starts!

Step 5: Mortgage Process

First, we will re-review your completed application and preliminary documents. If any items are still missing or need to be updated (new paystub or bank statement for example) then you’ll want to get it to us ASAP.

This time is also perfect for reviewing programs and rates. Most rates are locked for 30 days, but there are shorter and longer time periods available. Keep in mind NO Mortgage professional will know what will happen with rates. Like the stock market, mortgage rates are unpredictable. Very early on I heard the term “If you like it, lock it.” I always recommend sticking to that.

If your application is complete and we have a copy of the signed Purchase Contract, we will move your file into the next step, Processing.

Processing is usually takes 3-4 business days. The Processing department reviews everything the Loan Officer has provided and double checks that all items are in and all numbers are correct (purchase price, down payment, taxes, insurance etc.) At this time usually the initial appraisal order goes out. You will receive an invoice to pay this appraisal. This should be the last item you pay upfront until closing.

After Processing, your file will go into Underwriting for initial approval. This can also take 3-4 business days. The Underwriter is the final person who will look through your loan and officially approve it.

After initial approval, there may be some additional items needed to final approval. These include the appraisal, updated documents (pay stubs or bank statements if they are needed/available etc.) and any outstanding title work. If all is in, we will resubmit your file to the Underwriter for the final approval.

Step 6: Closing (Clear To Close!)

You’re almost home! After your loan is completely approved, we will get what’s called a Clear To Close. This means the Underwriter is completed with the file and can move to the Closing Department.

The Closing Department will work with the Title Company in ensuring all taxes, insurance, fees are correct. They calculate these numbers to the day. Before closing you will receive a Final Closing Disclosure with these exact numbers. The “Cash To Close” section will contain the final and exact amount you’ll need to bring to closing. You’ll come to closing with Cashiers Check for with this amount.

When you get to the Title Company, you’ll sign all documents needed. Make sure to bring at least 2 forms of ID. After signing, the title company will work on funding dispersing the funds to the seller. You’ll usually come back in an hour or so and to pick up your keys!

Congratulations, you’ve bought a home 🙂

Quick Tips

- When searching for a Home, you’ll know the right one when you walk in. PLEASE don’t settle for a home you’re not happy with. You might need a “starter” home before purchasing your dream home, but this still doesn’t mean you should settle.

- Understand the total cash to close you’ll need and always work closely with your Agent & Mortgage Loan Officer. Not all homes are equal and not all areas are equal. Where you qualify for a home in one neighborhood, might mean a different story across the street.

- Take note that the mortgage process of buying a home isn’t difficult but it definitely requires attention. Please keep an eye out for emails, calls or texts.

- The documents we ask for are not reasons to decline your loan application. We want to help you close. Most documents are needed for compliance or guideline purposes.

- If you are unsure of the document we are asking for, please ask. Most documents can be obtained from someone or somewhere. For example, a 2-year old Year End Pay Stub can be obtained from your HR department without digging through old paperwork. Additionally, insurance documents can be obtained directly from your agent or insurance provider etc.

- Close dates are an estimate. This is a HUGE tip on which I knew when going through the process. Believe it or not, you probably won’t close on your close date. There is HIGH chance you’ll close early or a bit late. The entire process of buying a home has a TON of moving parts. People, scheduling, compliance laws, holidays and more. If you don’t close on the closing date, it’s ok. Work closely with your Agent and Mortgage Loan Officer to ensure you are protected and all appropriate parties know what’s going on.