Buying a second home can be a great investment in your future. Not only can it help you earn an additional income but provide a retreat from everyday life too. Second home has become a vacation spot where people can spend their holidays instead of hotels and vacation rentals.

With the low mortgage rates, it has become more affordable than ever for people to finance their vacation homes. However, buying a second home is not similar to purchasing a primary residence.

Let us tackle some things you need to know before getting yourself a second home.

Financing a Second Home

Second homebuyers commonly use mortgage instead of paying in cash. Unlike primary residence, financing a second home or vacation home comes with different rules.

- At least two months of reserves is required

- Second home requires a higher credit score than for the first home

- Options come with lower rates than rental or investment property loans. However, rates are higher than primary residences.

- Your monthly mortgage expenses may be defrayed by renting out your vacation home when not in use. It might still qualify as a “vacation” residence.

- The second property must be occupied at least part of the year.

An FHA-insured loan is a prime choice for many homebuyers since it only requires a down payment of just 3.5%. Lenders even offer the loans to borrowers with lower credit scores, down to 580 or even lower in some cases. But for the second homebuyers, FHA loans cannot be used for purchasing. FHA loans are only limited to homes that are the borrowers’ principal residence.

The following are the second home financing options second homebuyers could take advantage of:

OPTION 1: CASH

If you have managed to save enough, the easiest method to pay for a vacation property is through an all-cash purchase. According to a survey conducted by National Association of Realtors (NAR) to homebuyers and sellers, 25% of all buyers in April 2021 paid in cash. 17% of sold homes belonged to vacation and investment properties.

OPTION 2: HOME EQUITY LOAN

A home equity loan may be an option for homeowners who have substantial equity in their property. On the other hand, lenders are less willing to approve home equity loan that drains much equity from the principal property thinking that values could continue to decline. Also, lenders assume that when homeowners run into financial trouble, they could be more aggressive to keep up with the payments for principal residence rather than the second property.

OPTION 3: CONVENTIONAL LOAN

Conventional loan is another option for financing your second home. Prepare yourself in making larger down payment, paying higher interest rate, and working with a tighter set of guidelines. 20% minimum down payment is often required for a vacation home. But some lenders already increased it to 30% or even 35%.

To qualify for a conventional loan on a second home financing, you will be needing higher credit score standards of about 725 or even 750; varies depending on your lender. You also need a strong monthly debt-to-income ratio, specifically when attempting to limit your down payment to 20%. The borrowers have to fully document their income and assets for a second home loan. This is because lenders will require significant cash reserves to ensure you have the means to handle payments for the two homes.

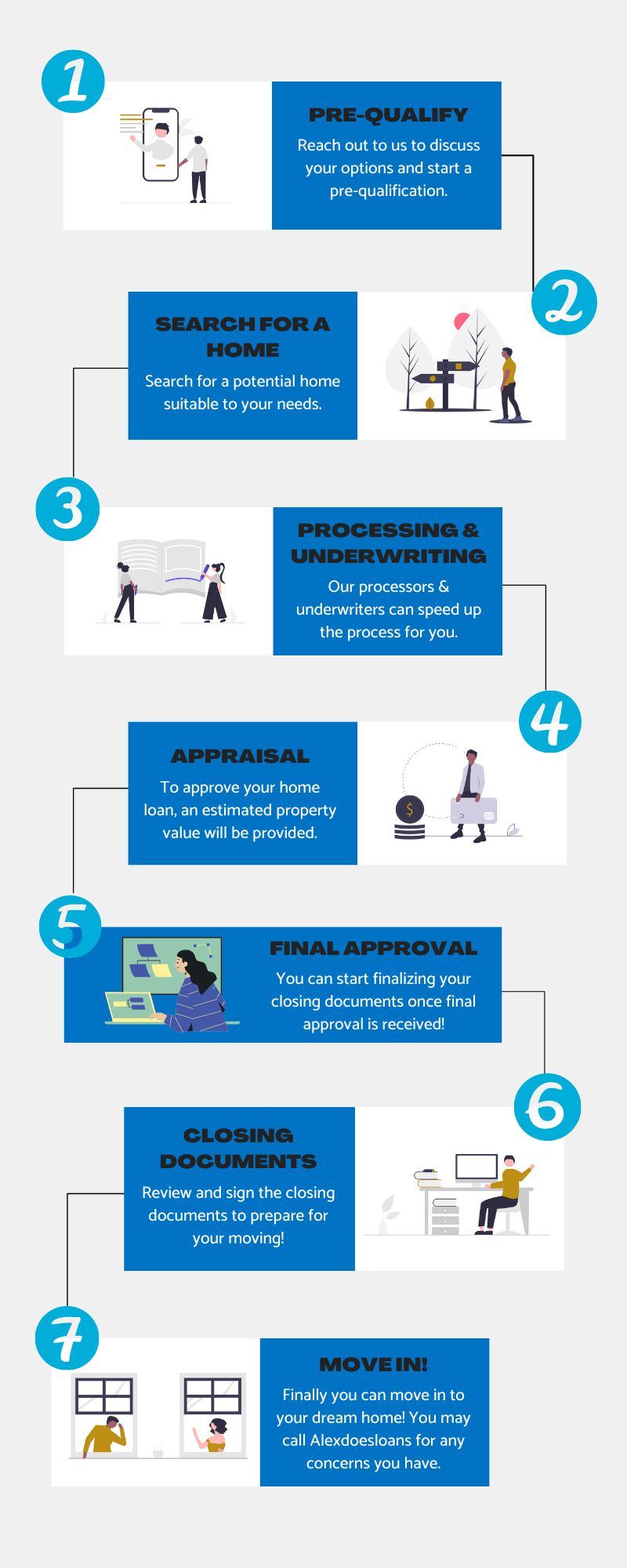

LET US HELP YOU FIGURE OUT EVERYTHING YOU NEED TO KNOW WHEN BUYING YOUR FIRST HOME

Borrower Requirements For Second Home

At least 10% down is required when purchasing a second home – the most important rule that is not negotiable at all.

Aside from the down payment, below are the guidelines for the second home mortgages. They are subject to flexibility, meaning it is still possible to be qualified even without a perfect credit score nor a huge down payment. When one area of your application is quite weak, you may compensate for it by being strong in other areas.

- Typically, a credit score of 680 or higher

- A credit score of 640-679

- Up to 45% of debt-to-income ratio

Property Requirements For Second Home

Apart from the down payment, credit score and debt-to-income ratio, certain property guidelines need to be met.

- One-unit home (duplex, triplex, or four-plex not allowed)

- Owner must have occupied some portion of the year

- Suitable for year-round use

- Solely belongs to the buyer

- Not full-time rented, and is not under a timeshare arrangement

- Not company-managed property that can control the occupancy

Your second home must invoke a ‘recreational’ vibe, not a rental or investment property posing as one.

Renting the home full time is considered an investment property, not a second home. Thus, it will be subject to higher interest rates and different loan requirements.

The very first rule for second homebuying is that you must occupy the home part time. You must stay there for part of the year. Financing a property using the second home mortgage and renting it out full time is not allowed.

Additionally, having a reasonable distance between the primary residence and the second home is preferred. It also helps if the house is located in a resort community or area.

Am I Ready To Purchase A Second Home?

Even if you think you can already afford to buy a second home, it wouldn’t still be easy. Be sure that it is a purchase you can afford particularly if it will remain vacant for several months. Here are some financial factors to keep in mind.

Down Payment

As mentioned earlier, buying a second home comes with a set of different rules compared to buying your primary residence. Unless you are paying in cash, you will be required to pay a down payment and a mortgage with interest.

Oftentimes, second homes are being asked with a higher down payment. This is mainly because second home has higher risk and greater chance of default in the event of financial hardship – as compared to a primary residence. In most cases, it takes at least 10% down to buy a vacation home – only if you have very strong credit score, low debts, and so on. Your mortgage lender may require at least 20% down if you have low credit score or higher DTI ratio. A down payment of 25% or higher can make it easier qualifying for a conventional loan.

When you are short in cash, you may borrow your down payment.

According to National Association of REALTORS, about a fifth of buyers tap equity from their primary residence to make a down payment. Possibly through cash-out refinance or a home equity line of credit.

In the case of low rates, cash-out refinance could have the double benefit of covering your second home down payment and lowering the interest rate on your primary home loan.

But what about FHA or VA loans?

The U.S government does not sponsor second homeownership. It loans primary residences only with a goal of encouraging primary homeownership. On the other hand, if the seller acquires government-backed loan against the property, you may be able to assume the seller’s loan.

Credit Score

A slightly higher credit score is required for second homes than for primary residences. For instance, Fannie Mae sets its minimum FICO for primary home purchase loans at 620. But a second home loan backed by Fannie Mae requires a minimum credit score of 640 – that’s with a 25% down payment and DTI below 36%.

Failure to settle a 25% down requires at least 680 and low debts, or 720 with a higher DTI ratio.

Credit score requirements may vary depending on the lender. Shop around and compare lenders that could with your needs and goals and offer you the best rates at the same time.

Required Income

DTI requirements highly depend on how much you can settle with your down payment and credit score. With a 660 FICO and at least 25% down, Fannie Mae allows a DTI up to 45%.

Acquiring a 45% DTI means that your total monthly payments add up to 45% of your gross income.

For instance, making a $10,000 monthly before taxes, a maximum of $4,500 could be your total monthly debt payment. This includes your mortgage payments for both primary and second mortgage, auto loans, and other ongoing debts.

Vacation properties do not have rental income to offset the mortgage payment. You need to qualify with income from sources other than the property you are buying.

Buying a multi-unit vacation home, whether you are planning to rent it our not, most lenders treat the purchase as an investment property.

Mortgage Rates

Undoubtedly, second homes have slightly higher interest rates than first home mortgage loans.

Take a look at your assets, credit, and income like an underwriter does to ensure you qualify for financing your second home

Pay down outstanding debts and improve your credit score beforehand to have the best chance at low mortgage rate. A 25% down or more can even help you get a lower second home mortgage rate.

Additional Expenses For Second Home

Purchasing a second home comes with additional responsibilities to take care of. Planning before purchasing is a must since you will be maintaining two households at the same time, at that could cost you more.

Qualifying for a mortgage loan is different from affording a home.

Mortgage underwriters only see through the expenses pertaining to principal, interest, property taxes, insurance, and HOA dues – if applicable. If all the said expenses are checked out, then you are approved.

However, there’s more to these said expenses. If the second home is quite far, then it’s wise to consider travel costs. Also, there’s maintenance and repairs, utilities, furnishings, and household items.

If you rent your home part-time, you may be able to offset some of the costs. However, second home mortgages require you to occupy the home at least part of the year.

LEARN HOW YOU CAN REFINANCE FOR HOME IMPROVEMENTS

Getting yourself a second home is one excellent way to expand your portfolio of real estates and generate another stream of income. However, before buying your home, decide what it will be used for and what location will it make most sense.

Secure money not only for monthly mortgage and interest payments, but also for property taxes, homeowners’ insurance, utilities, and other associated fees.

FHA-insured loans work when buying your primary residence. They allow small down payments as well as middling credit score. However, second homes cannot be purchased with FHA-insured loans. You may alternatively apply for a standard loan, but it comes with larger down payment, higher interest, and stricter requirements for mortgage than on your primary residence. Otherwise, you may pay in cash, or get a home equity loan on your primary home, if possible.