It takes a while to get back on track with your financial life after going through bankruptcy. Refinancing after bankruptcy is possible, however, it is not something you will be able to do right away. If you have a mortgage you’d like to refinance, you need to prove to the lenders that you are creditworthy.

Bankruptcy often gets bad critiques, but it also helps consumers who are overwhelmed by debt. Filing for bankruptcy provides federal protection while the consumer works on paying off his obligations. It is possibly a reasonable move for your financial future when you’ve exhausted every options.

Understanding HOW TO REFINANCE AFTER BANKRUPTCY

The bankruptcy comes in several types, and it may not be equal in the eyes of mortgage lenders. Various factors such as the discharge date could affect the potential refinancing differently. A discharge date refers to the time when a debtor who filed for bankruptcy is no longer legally liable for – or required to pay back – certain types of debt.

There are two types of bankruptcy you are most likely to take advantage of – Chapter 7 and Chapter 13 Bankruptcies. Refinancing after a bankruptcy highly depends on the type of bankruptcy you have filed. Let’s go over each of these two main types of bankruptcy.

Chapter 7 Bankruptcy

Chapter 7 Bankruptcy is also referred to as traditional bankruptcy. Your assets are liquidated and used to settle your debts. Meaning, certain items of value you are owning like jewelries, cars, or an investment account, can be sold to pay off your creditors. You may also lose your home if any of your equities are eligible for collection.

Generally, bankruptcy court issues a discharge order 60 to 90 days after the date first set for creditors to meet. With chapter 7 bankruptcy, certain types of debt might be released except for things like student loans, child support, and court-ordered judgments. Also, bankruptcies stay on your credit report for 10 years.

Chapter 13 Bankruptcy

Chapter 13 reorganizes your debt into a payment plan in order to pay back within 3 to 5 years. This type of bankruptcy allows you to keep your properties with an assurance of making payments on your debt.

Chapter 13 Bankruptcy stays on your credit report for 7 years. Once repayment period has ended, all the remaining debt is discharged.

Filing for chapter 7 bankruptcy might give you a much difficult time getting a refinance. Lenders may see it as a negligence in reaching an agreement to pay back your debt with past creditors. Thus, making it a risk for you to borrow. Your credit report will also reflect this type of bankruptcy a lot longer than chapter 13, and this can negatively impact your credit score.

LET'S GET YOU HOME.

How Lenders See Chapter 7 Bankruptcy & Chapter 13 Bankruptcy

Regardless which type of bankruptcy you will file, your lenders must know that your finances are under control before refinancing. You may provide proofs of your income and documentation that proves your bills are paid on time.

A letter from your employer also certifies your long-term potential with the company and an excellent performance. This proves that you are likely to stay in your job and not fall into debt.

You cannot refinance while bankruptcy waiting period is still ongoing. Each of the bankruptcy types have specific waiting periods to be followed. On that time frame, you are not allowed to get a mortgage loan or refinance.

Waiting Periods Before You Can Refinance After Bankruptcy

Chapter 7 Bankruptcy > Refinancing your loan will be granted at least 2 years after the discharge of dismissal date. Most lenders require in their conventional loan a 4-year standard. However, 2-year standard can only be applied to government-backed loans such as FHA loans and VA loans. Jumbo loans on the other hand, require a waiting period of 7 years.

Chapter 13 Bankruptcy > If you already have any of the government-backed loan like FHA loan or VA loan, you can qualify for refinancing in just a day after the discharge date. A 2-year standard will be followed if you have a conventional loan, however the bankruptcy must have been filed more than 4 years from the time your credit is pulled. Otherwise, it can be dismissed more than 4 years ago. Jumbo loans still follow a 7-year standard waiting period.

Make sure to prepare necessary additional documents to back up your application. Documents depend on the loan program you applied for. Also, the lenders have specific standards you must meet. They apply to anyone with a bankruptcy with a single major exception. There are instances where you must wait 5 years if you have had more than one bankruptcy of any type over the last 7 years.

Check Mortgage Loan Programs

Pros & Cons of Refinancing After Bankruptcy

Refinance After Bankruptcy Advantages

The refinance comes with several potential benefits you could also enjoy to avoid going through a bankruptcy again in the future.

- Lowering monthly payment & interest rates > If you are looking to lower your monthly housing payment, you can do so by refinancing. Refinancing it into a loan with a longer term will lengthen the amount of time you will have to pay back. Also, if the current rates are lower than what you are paying, refinancing to lower interest rates can slim down the amount you will pay each month. However, keep in mind that you may not always have access to the best interest rates unless your previous bankruptcy expired from your credit profile.

- More manageable payments > Monthly payments can be lowered if you take a longer term during refinance. It can help you save from falling back into debt.

- Cash for covering debts > Just like chapter 7 bankruptcy, most bankruptcy types let you keep some form of equity in your home. You can take on a higher principal balance and get the difference in cash from your lender. This cash can be allocated towards debt payments and help improve your credit score faster.

Refinance After Bankruptcy Disadvantages

While there are couple of advantages in refinancing after bankruptcy, we still need to be aware of some things that could negatively impact us in this process.

- Closing costs are settled by you > Most refinances still require you to pay for the closing costs. It can be equivalent to 2% to 3% of the overall loan value. You can roll your closing costs into the principal of your loan if you have sufficient equity.

- Credit scores will be affected > Qualifying for a refinance requires specific credit standards. This rule applies to any type of loan you choose to apply for. While bankruptcy can negatively impact your credit rating, you should further work on raising it. Know your credit score and minimum credit requirements prior to application.

- Credit report may still reflect your old bankruptcy > Errors with credit reporting are common, and old bankruptcy may still reflect on your report. Regardless of the filed type of bankruptcy, credit reporting bureaus must remove it not later than 7-10 years. Simply note the bankruptcy date and make a follow up.

Refinancing Your Home Loan After Bankruptcy

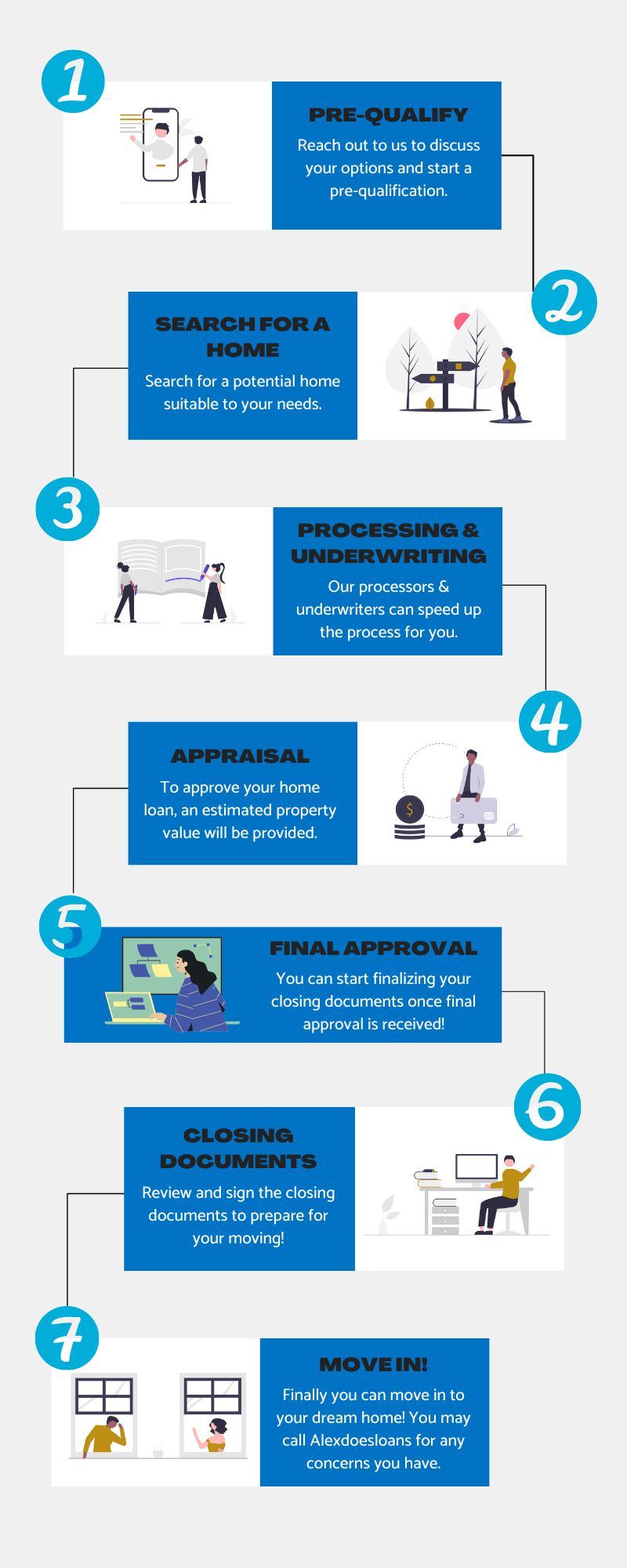

Step 1: Determine Whether Minimum Requirements are Met

It’s worth knowing and understanding types of mortgages before purchasing a home. Typically, this requires you a credit score of at least 620 for conventional loans, while 580 for FHA loans. Lenders check home equity as well as an acceptable debt-to-income ratio to assess your eligibility.

Step 2: Apply for a Refinance

At this stage, you are free to look around and compare rates with several lenders. Applying to the same lender you had with the loan is not required at all.

You must be on-point with your goals for refinance in order to choose the right lender and the best offering. You must be aware of the following when comparing lenders:

Minimum Loan Standards: Aside from the debt or equity standards, make sure first that you meet the lender’s minimum credit score standards.

Rates & Fees: Every lender comes with their own set of rates and fees. Take time in choosing the most reasonable lender.

Availability: Refinance application is not just all about rates, fees, and minimum requirements. You also have to make sure that you are working with someone who can make time for you and a customer service that can meet your needs and goals.

After all the comparison and decision making, it’s time for you to prepare all your documents. Organize these documents before applying for your new loan. Documents include:

- At least two latest W-2s

- At least two latest pay stubs

- At least two latest bank statements

Step 3: Lock In Your Mortgage Rate

Interest rates fluctuate in a day-to-day basis. Therefore, looking in your mortgage rate is an option to protect the rate you were given until the closing of the loan. The rate lock period often lasts 30-60 days. It requires an additional fee if ever you prefer later than that.

Step 4: Underwriting and Appraisals

The lender requires a home appraisal to ensure that the value they are lending you is not expensive than the value of the home.

Then, the lender underwrites after you have completed the documentation and paper works. Most likely, the process takes about 1-2 weeks as long as no third-parties are involved.

Cleaning up the home and fixing any issues help homeowners prepare for an appraisal or increase home value.

Step 5: Closing

The lender sends the Closing Disclosure once everything is set to go. A closing meeting proceeds to go over the numbers and loan details, documents signing, and setting of closing costs.

The closing disclosure comes with all the terms and tally of how much you will pay in the closing costs. Once received, the lender should be advised to schedule a closing meeting.

The following documents should be brought with you to closing:

- Photo identification

- Cashier’s check or any proof of wire transfer for your closing costs

- Closing disclosure

Closing meeting is an opportunity for you to settle with the loan and ask any last-minute questions. Once settled, you can already sign your loan agreement and finish your refinance.

TAKE A DEEPER LOOK AT HOW WE DO WHAT WE DO.

It is not impossible to refinance after bankruptcy. In fact, it only depends on the type of bankruptcy you filed for, and whether you have met the standard requirements of your lender.

It may not be something that could happen right away, but you are definitely a step closer to your goal. Your lender will be with you every step of the process. From application processes to looking in your interest rate, to appraisal and closing meeting. Attend the scheduled closing meeting, sign off your new loan and keep up with your payments. Doing so improves your credit and finances over time.