Easy refinance requires a lot of time, patience, and effort. Certain factors and involved that could affect your decision in refinancing such as current interest rates, amount of time to recoup closing costs, and how long you plan to live in your home. In some cases, it is a wise decision, but not financially worthy for others.

Unlike with the first loan as a first-time homebuyer, it is easy to refinance because you already own the property this time. Also, this will be an easy refinance if you have built up significant equity. However, it is not a smart financial move if you are refinancing to tap the equity or consolidate debt because it can increase the years you will owe on your mortgage.

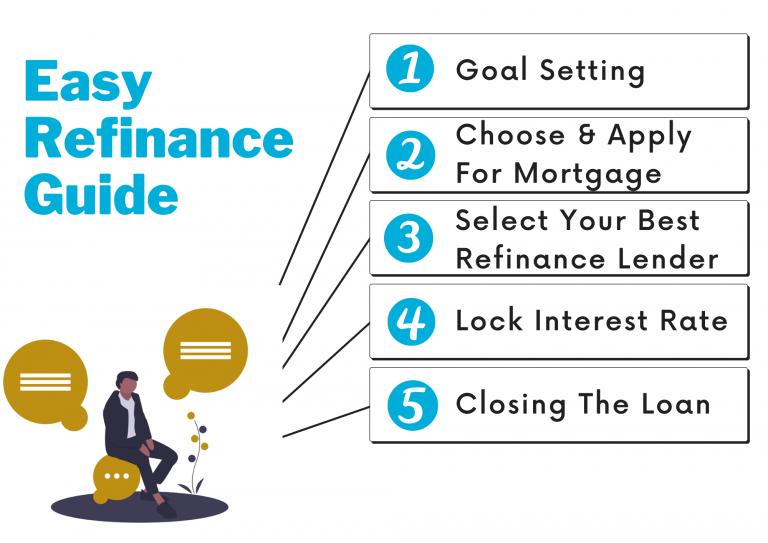

Easy Refinance guide

Generally, a minimum credit score of 620 is required when financing a rental property. But in some cases, you should have a credit score of 740 or higher to secure the best interest rates and terms. This credit score of 740 is acknowledged as an ideal range.

Goal Setting

Why are you looking for an easy refinance? Is it to reduce your monthly payment? To pay off the loan immediately? To tap into equity? To get rid of FHA mortgage insurance? To switch from adjustable-rate mortgage to fixed-rate loan?

Set specific financial goals before you apply for a Texas mortgage refinance.

Choose and Apply For Mortgage

Feel free to shop around and compare mortgage refinance rates for at least 3 to 5 lenders Do not forget to include the associated costs when estimating the mortgage refinance rates.

You should be able to submit a mortgage application within a two-week period to minimize impact on your credit score.

Select Your Best Refinance Lender

Upon receiving the loan estimate document, compare each refinance lender and pick the one that makes financial sense to you.

Loan estimate document gives you an idea how much you will need for the closing costs.

Lock Interest Rate

A lock-in or rate lock refers to the interest rate that won’t change between the offer and closing. As long as you close it within the specified period, you can no longer reverse it. You and your lender will be closing the loan prior to rate lock expiration.

Loan estimate document gives you an idea how much you will need for the closing costs.

Closing The Loan

Upon closing of the loan, you will be paying for the closing costs indicated in the loan estimate and in the closing disclosure.

Loan estimate document gives you an idea how much you will need for the closing costs.

Mortgage loan refinance potentially helps you lower your payment or change the loan term. You probably want to pay off your loan faster, so you don’t need to worry about it once you reach your retirement period. As a result, you will be provided with the flexibility of a lower monthly payment to spend or save up money in other ways.

For some, cash-out refinance may be an option to turn the equity they built in their house into a cash. The cash then can be used to provide financial aid to big expenses like home improvement.

If your prime goal is an access to lower monthly payments, it makes financial sense to refinance when the current interest rates are lower than your current rate. Homeowners will also want to scrutinize the closing costs to assure the interest-rate savings would offset the necessary upfront cash.

Shortening your loan term from 30-year loan to a 20-, 15-, or a 10-year loan, those rates will lower than the traditional 30-year – fixed in most interest rate environments. Thus, this can save you money in the foreseeable future.

Get Personalized Rate Quote for FREE!

"*" indicates required fields

When Does It Make Financial Sense To Refinance To A Higher Interest Rate?

A lot of reasons cause people to consider refinancing – even those unrelated to the rate environment. Some mortgage borrowers worry about the rate adjustment, so they end up shifting from adjustable-rate mortgage to a fixed-rate loan.

Also, other mortgage borrowers consider refinancing to a higher rate to consolidate high interest debt for overall interest savings. Thus, one easy payment and a better tax deduction. However, it is also wise to seek professional advice from a financial advisor. This could enlighten you about tax details and the advisability of converting other debt into a debt secured by your home.

Why Should I Consult A Mortgage Lender When Considering Refinancing?

While you may already have an idea of what you can accomplish by refinancing, a mortgage lender plays a vital role in assessing your financial situation and goals. You can better weigh the pros and cons of easy refinance, and thus help you decide whether mortgage refinance really makes sense for you. Your mortgage lender will ask you several questions to understand your goals and motivations such as how long you will likely stay in the home.

Doing so can help you find a breakeven point where refinance truly makes sense.

Have a question? Let's chat!

Things To Consider When Refinancing

Consider Closing Costs

Closing costs are always involved. The outlay you make covers the cost for title insurance, attorney’s fees, appraisal, taxes, transfer fees, and many more. The refinancing costs, which can be 3-6% of your loan’s principal, are almost as high as the cost of the initial mortgage and may take some years to recoup.

If you are thinking of reducing your monthly payments, keep in mind the no-closing-cost refinancing from lenders. Even if there may be no closing costs, the bank might recoup those fees by charging you a higher interest rate.

Consider Duration Stay In The Home

Whether you will refinance or not, you will still consider calculating how much savings you could make once refinance is completed. For instance, you took a loan of $200,000 for 30-years term. Your interest rate was fixed at 6.5% and your monthly payment was $1,257 when you first assumed. When interest rates go down to 5.5% fixed, it could reduce your monthly payment to $1,130. Your savings every month will be $127, or $1,524 every year.

Your lender will calculate the overall refinance cost should you decide to proceed. For instance, the cost is approximately $2,300, you can divide the figure by your savings to determine your break-even point. In this case, the home for 2 years of longer, refinancing would make sense one-and-a-half years in the home [$2,300 / $1,524 = 1.5]. If you plan to stay for more than 2 years, mortgage refinance would make sense.

If you want to refinance with reduction of less than 1% (e.g 0.5%), the overall cost will change. Using the same example, your monthly payment would be $1,194, $63 monthly savings of $756 annually [$2,300 / $756 = 3.0]. This means you will have to stay in the home for 3 years. IF you have higher closing costs (e.g $4,500), it will then change to nearly five-and-a-half years.

Consider Private Mortgage Insurance (PMI)

When home values decline, many homes are being appraised for much less than they had been appraised in the past. If this pose to be the case when you are considering easy refinance, the lower value of your home may mean your lack of sufficient equity to reach a 20% down payment on the new mortgage.

A larger cash deposit will be required if you are planning on refinancing. Also, you may need to bring PMI with you, which can eventually increase your monthly payment. Thus, even with a drop in interest rates, your savings might not dramatically increase.

A refinance that removes your private mortgage insurance could save you money and might be worth doing for the sole reason. Having a house with 20% or higher equity means you no longer need to pay PMI, unless you have an existing FHA mortgage loan, or you are considered a high-risk borrower. If you are currently paying PMI and you don’t want it to be removed, have at least 20% equity.